Everything about Real Estate Reno Nv

Getting My Real Estate Reno Nv To Work

Table of ContentsThe smart Trick of Real Estate Reno Nv That Nobody is Talking AboutHow Real Estate Reno Nv can Save You Time, Stress, and Money.The Definitive Guide to Real Estate Reno NvReal Estate Reno Nv Fundamentals ExplainedIndicators on Real Estate Reno Nv You Need To KnowMore About Real Estate Reno Nv

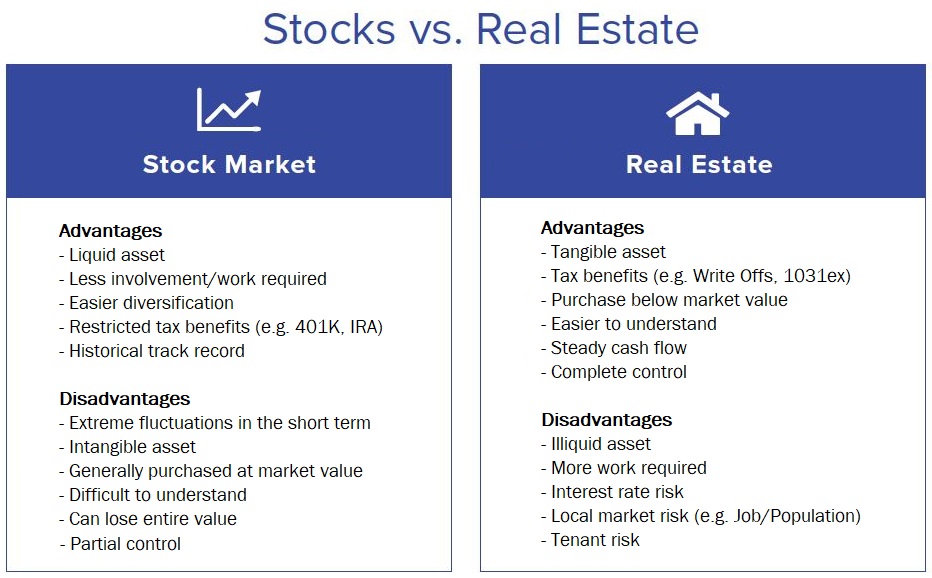

The benefits of purchasing property are countless (Real Estate Reno NV). With appropriate assets, investors can appreciate foreseeable money flow, outstanding returns, tax advantages, and diversificationand it's possible to leverage real estate to build wealth. Considering spending in realty? Right here's what you need to understand about real estate advantages and why realty is taken into consideration a great investment.

The advantages of buying property include passive earnings, secure capital, tax benefits, diversity, and utilize. Realty financial investment counts on (REITs) use a method to buy property without having to have, run, or finance homes. Money circulation is the earnings from a genuine estate investment after mortgage settlements and operating costs have actually been made.

Actual estate values tend to enhance over time, and with a good investment, you can turn a revenue when it's time to sell. As you pay down a residential property home mortgage, you build equityan asset that's part of your net well worth. And as you develop equity, you have the utilize to get more buildings and increase cash money flow and wealth also extra.

Realty has a lowand in many cases negativecorrelation with other major asset classes. This indicates the addition of actual estate to a portfolio of varied assets can lower portfolio volatility and give a higher return each of danger. Utilize is the use of different economic instruments or obtained resources (e.

The 6-Second Trick For Real Estate Reno Nv

As economic climates broaden, the need for actual estate drives leas greater. This, consequently, converts into higher resources worths. For that reason, realty has a tendency to maintain the acquiring power of resources by passing a few of the inflationary stress on to lessees and by including several of the inflationary stress in the form of funding admiration.

There are a number of manner ins which having genuine estate can protect against inflation. First, residential property worths may increase more than the price of inflation, bring about capital gains. Second, rental fees on investment homes can boost to stay on par with inflation. Residential properties financed with a fixed-rate car loan will certainly see the loved one quantity of the regular monthly home mortgage settlements drop over time-- for instance $1,000 a month as a set settlement will become much less troublesome as inflation wears down the purchasing power of that $1,000.

However, one can make money from offering their home at a rate more than they paid for it. And, if this does happen, you might be liable to pay tax obligations on those gains. Regardless of all the advantages of buying property, there are disadvantages. One of the primary ones is the absence of liquidity (or the loved one trouble in transforming a property right into cash money and money into a possession).

The Only Guide for Real Estate Reno Nv

Yet among the simplest and most usual methods is simply acquiring a home to lease to others. So why buy property? It calls for much more job than just clicking a couple of switches to invest in a common fund or supply. The truth is, there are numerous realty advantages that make it such a preferred selection for skilled investors.

Yet the rest goes to paying for the loan and building equity. Equity is the value you have in a building. It's the difference between what you owe and what the residence or land deserves. With time, normal settlements will eventually leave you owning a residential or commercial property complimentary and clear.

The 10-Second Trick For Real Estate Reno Nv

Any person see this here that's shopped or loaded their tank just recently understands just how inflation can ruin the power of hard-earned cash. Among one of the most underrated realty benefits is that, unlike numerous conventional financial investments, realty worth has a tendency to go up, even throughout times of noteworthy inflation. Like various other vital possessions, real estate typically retains value and can for that reason operate as an outstanding location to invest while higher costs gnaw the gains of different other investments you might have.

Appreciation refers to cash made when the overall value of a possession increases between the moment you acquire it and the moment you sell it. For genuine estate, this can suggest significant gains because of the normally high prices of the assets. It's crucial to remember recognition is an one-time thing and only provides cash when you offer, not along the method.

As pointed out previously, capital is the money that comes on a monthly or yearly basis as an outcome of owning the residential or commercial property. Usually, this is what's left over after find here paying all the needed expenses like mortgage payments, repairs, tax obligations, and insurance policy. Some homes may have a considerable capital, while others may have little or none.

The smart Trick of Real Estate Reno Nv That Nobody is Talking About

New investors might not truly recognize the power of take advantage of, but those that do open the capacity for huge gains on their financial investments. Usually speaking, utilize in investing comes when you can have or regulate a bigger amount of properties than you might otherwise spend for, with making use of credit score.